Part two analyzing transactions into debit and credit parts – Part two of our comprehensive guide delves into the intricate world of analyzing transactions into debit and credit parts, a fundamental aspect of accounting that lays the foundation for accurate financial reporting. As we embark on this journey, we will unravel the concepts, techniques, and implications of this essential accounting practice.

By mastering the art of transaction analysis, you will gain a deeper understanding of how businesses record and process financial events, enabling you to make informed decisions and effectively manage your organization’s finances.

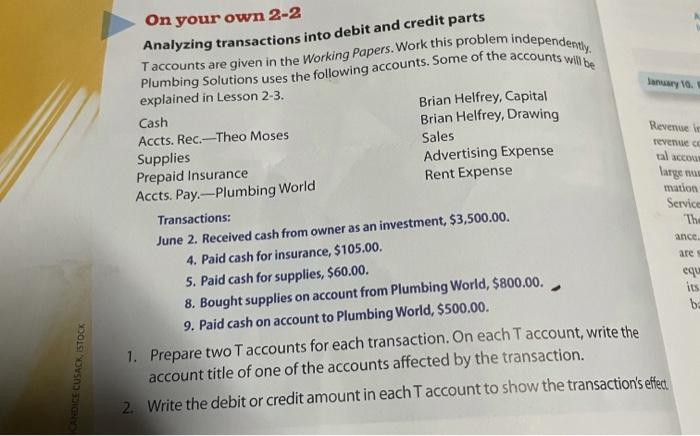

Transaction Analysis Basics

Transaction analysis involves breaking down business transactions into their debit and credit components. Each transaction has two aspects, a debit and a credit, that are recorded in the accounting system to maintain the accounting equation. Understanding how to analyze transactions is crucial for accurate financial reporting.

Types of Transactions

- Asset Acquisition:Debit Asset, Credit Cash/Payable

- Expense Incurred:Debit Expense, Credit Cash/Payable

- Revenue Earned:Debit Cash/Receivable, Credit Revenue

- Liability Incurred:Debit Liability, Credit Cash/Revenue

The Accounting Equation

The accounting equation, Assets = Liabilities + Equity, serves as the foundation for transaction analysis. Every transaction affects at least two accounts and maintains the balance of the equation.

Debits:Increase Assets or Expenses, Decrease Liabilities or Equity

Credits:Increase Liabilities or Equity, Decrease Assets or Expenses

Double-Entry Bookkeeping, Part two analyzing transactions into debit and credit parts

Double-entry bookkeeping is a system that records each transaction in two separate accounts, ensuring that the accounting equation remains balanced. The total debits always equal the total credits.

- For every debit, there is an equal and opposite credit.

- Transactions are recorded chronologically in a journal.

- Journal entries are then posted to individual ledger accounts.

Debits and Credits in Financial Statements

Debits and credits are used to prepare financial statements, including the balance sheet, income statement, and statement of cash flows.

- Balance Sheet:Assets are debited, Liabilities and Equity are credited.

- Income Statement:Revenues are credited, Expenses are debited.

- Statement of Cash Flows:Cash inflows are credited, Cash outflows are debited.

Advanced Concepts in Transaction Analysis

Advanced concepts in transaction analysis include:

Compound Entries

Transactions that affect more than two accounts.

Reversing Entries

Entries made at the end of an accounting period to reverse accruals or deferrals.

Adjusting Entries

Entries made at the end of an accounting period to update account balances to reflect current conditions.

Essential FAQs: Part Two Analyzing Transactions Into Debit And Credit Parts

What is the purpose of analyzing transactions into debit and credit parts?

Transaction analysis helps accountants maintain the accounting equation (Assets = Liabilities + Equity) and ensures the accuracy and integrity of financial records.

How do debits and credits affect the accounting equation?

Debits increase assets and expenses or decrease liabilities and equity, while credits do the opposite, ensuring that the equation remains balanced.

What is the significance of double-entry bookkeeping in transaction analysis?

Double-entry bookkeeping requires that every transaction be recorded with equal debits and credits, ensuring the completeness and reliability of financial data.